tax deductions for high income earners 2019

Republic Of Armenia In Imf Staff Country Reports Volume 2019 Issue. The Medicare payroll tax is 29 which applies to earned income only.

Long-term capital gains tax rates are zero 15 percent and 20 percent for 2018 depending on your income.

. Short-term capital gains tax is always the same as ordinary income tax rates. For high-income taxpayers however a 28 tax is applied to income in excess of the following. Otherwise you pay 145 from each paycheck and your.

For individual coverage the limit is 3600. Normally AMT is taxed at a flat rate of 26. For family coverage the limit is 7200.

Related

All individuals that own these types of businesses can qualify for this 20 t ax rate deduction however there are limitations if you own a service business. If youre in a higher tax bracket you stand to pay more in short-term capital gains tax when you. One of the best ways that you can lower your taxable income is through pre-tax retirement contributions.

Each category has its own deductions and tax rates and general tax credits apply to net income after the three categories are totaled. Moderate to high-income earners may be. This rate is lower than the personal income tax rate.

Common Schedule 1 deductions for 2021 are. For individual coverage the limit is 3650. 28 AMT Tax Bracket.

1 2019 the maximum earnings that will be subject to the Social Security payroll tax will increase by 4500. Income is taxed at progressive rates of 3735. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post.

50 Best Ways to Reduce Taxes for High Income Earners. This means your allowance is zero if your income is 125140. You can also see the rates and bands without the Personal Allowance.

One of best ways for high earners to save on taxes is to establish and fund retirement accounts. For family coverage the limit is 7300. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

For example in 2020 we plan to deduct all of the following from our taxable income. If youre self-employed youll pay the full amount. Actual high salary earners have limited options really.

The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. You can deduct the amount you contribute to a tax. The contributions will still appear on IRS Form 5498 and may qualify some low- to moderate-income earners for the savers tax credit.

IRS Tax Reform Tax Tip 2019-28 March 21 2019. The taxation of high-income earners is indicative of the. Your Personal Allowance goes down by 1 for every 2 that your adjusted net income is above 100000.

American Congresswoman Alexandria Ocasio-Cortez has suggested a 70 percent top marginal tax rate Kapur 2019. You do not get a Personal Allowance on. The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income.

The article below was updated on Dec. New tax legislation made small reductions to income tax rates for many individual tax brackets. But the tax changes are only temporary and increased the standard deduction for.

Federal tax brackets on wages go from 10 percent for the lowest. Previously called above-the-line tax deductions taxpayers can take certain deductions on the 1040 Schedule 1 form. In Georgia however the deduction is only 2000 for individuals and.

Tax law changes in the Tax Cuts and Jobs Act affect almost everyone who itemized deductions on tax returns they filed in. If you are an employee.

How The Tcja Tax Law Affects Your Personal Finances

What Are Tax Expenditures And Loopholes

How The Tcja Tax Law Affects Your Personal Finances

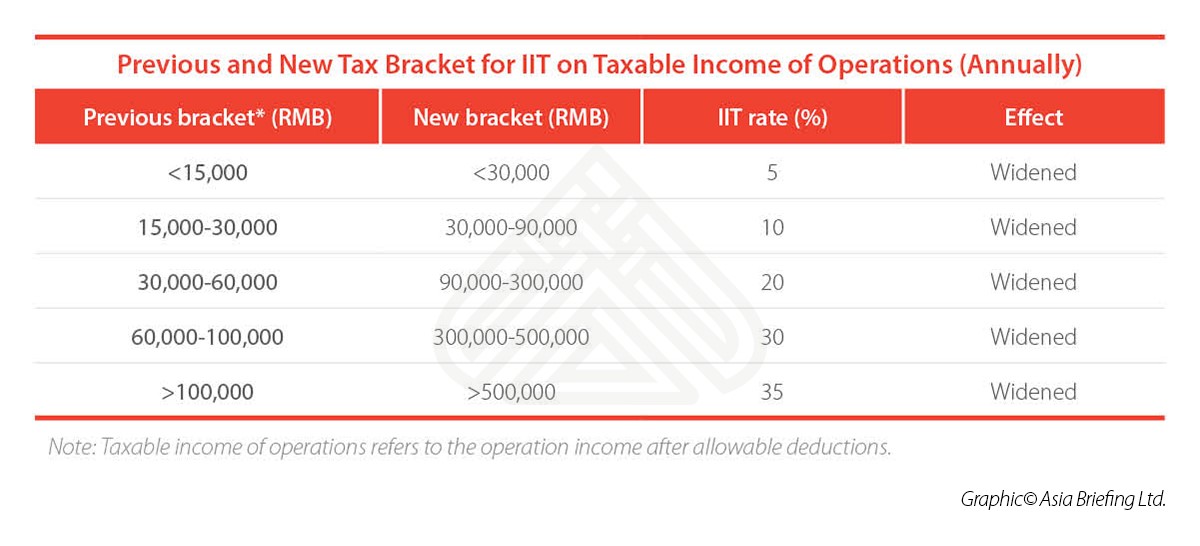

China S New Iit Law Prepare For Transition China Briefing News

How To Reduce Taxable Income For High Income Earners In 2021

Tax Policy For Inclusive Growth In Latin America And The Caribbean In Imf Working Papers Volume 2022 Issue 008 2022

Tax Strategies For High Income Earners Wiser Wealth Management

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2019 Budget Income Tax Cuts From 1 July 2018 Moschners Chartered Accountants

Tax Strategies For High Income Earners Wiser Wealth Management

Who Benefits More From Tax Breaks High Or Low Income Earners

Itemized Deduction Who Benefits From Itemized Deductions

5 Outstanding Tax Strategies For High Income Earners

The 4 Tax Strategies For High Income Earners You Should Bookmark

5 Outstanding Tax Strategies For High Income Earners

Who Benefits More From Tax Breaks High Or Low Income Earners

How Do Marginal Income Tax Rates Work And What If We Increased Them

Tax Agent Fees A Commonly Overlooked Tax Deduction